It is called the T-account because bookkeeping entries are shown in a way that resembles the shape of the alphabet T. It depicts credits graphically on control with fairness in transfer pricing the right side and debits on the left side. Each example of the T-account states the topic, the relevant reasons, and additional comments as needed.

When Cash Is Debited and Credited

Then, the journal entry is moved into the ledger, in the form of a T account. A double entry system is time-consuming for a company to implement and maintain, and may require additional manpower for data entry (meaning, more money spent on staff). These errors may never be caught because a double entry system cannot know when a transaction is missing.

- A double entry system is considered complex and is employed by accountants or CPAs (Certified Public Accountants).

- With the outstanding bill paid, accounts payable account is debited by £700, reducing its value and showing that I no longer owe this amount.

- Finally, the difference between the two numbers is the balance on the T-Account.

- A T-account is an informal term for a set of financial records that uses double-entry bookkeeping.

How much are you saving for retirement each month?

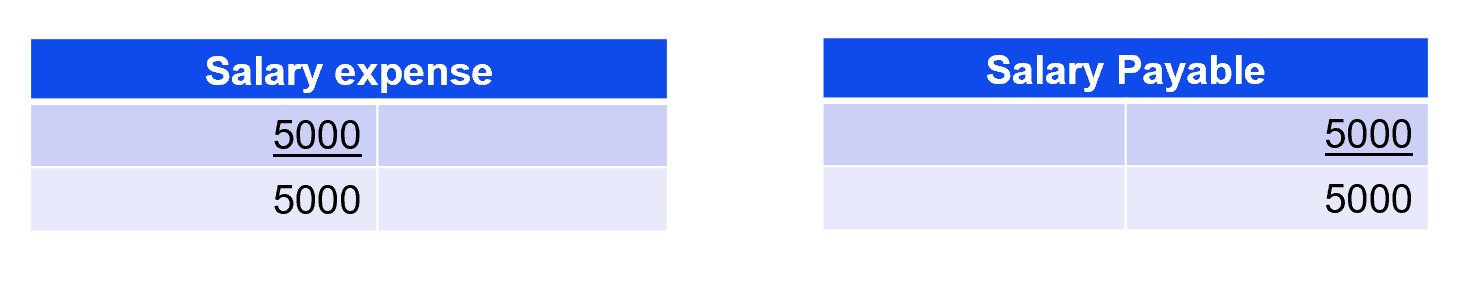

T-accounts are used to track individual account balances and transactions, while trial balance summaries are used to ensure the overall accuracy of a company’s financial records. The bottom set of T accounts in the example show that, a few days later, the company pays the rent invoice. T-accounts can also be used to record changes to the income statement, where accounts can be set up for revenues (profits) and expenses (losses) of a firm. For the revenue accounts, debit entries decrease the account, while a credit record increases the account. On the other hand, a debit increases an expense account, and a credit decreases it.

T Account Template

Although it may lack the detail which the ledger provides, it provides the main information, which is the amount it’s being debited/credited by. This transaction will decrease ABC’s Cash account by $5,000, and its liability Notes Payable account will also decrease by $5,000. To reduce the Cash account, the account must be credited since it is an asset account. On the other hand, the Notes Payable account is expected to be debited since it is a liability account.

Comprehensive Guide to Inventory Accounting

The debit entries entered on the left side of the T account should always balance with the right side, or credit side of the account. With Deskera you can effortlessly manage and oversee your invoices, credit notes, business expenses, financial reports all in one place. We at Deskera have spent over 10 years working with small business owners from across 100+ countries, to build accounting software that suits any type of business.

The name of the account is placed above the “T” (sometimes along with the account number). Debit entries are depicted to the left of the “T” and credits are shown to the right of the “T”. The grand total balance for each “T” account appears at the bottom of the account. A number of T accounts are typically clustered together to show all of the accounts affected by an accounting transaction.

A double entry system is a detailed bookkeeping process where every entry has an additional corresponding entry to a different account. Consider the word “double” in “double entry” standing for “debit” and “credit”. The two totals for each must balance, otherwise there is an error in the recording. As a refresher of the accounting equation, all asset accounts have debit balances and liability and equity accounts have credit balances.

T Accounts always follow the same structure to record entries – with “debits” on the left, and “credits” on the right. A business owner can also use T-accounts to extract information, such as the nature of a transaction that occurred on a particular day or the balance and movements of each account. A current asset whose ending balance should report the cost of a merchandiser’s products awaiting to be sold. The inventory of a manufacturer should report the cost of its raw materials, work-in-process, and finished goods. The cost of inventory should include all costs necessary to acquire the items and to get them ready for sale. A t-account is a visual representation of a financial account for a financial accounting period.