Contents:

This is a decrease of -43% compared to the previous 30 ricardo strategic consultings. Only 3 people have searched for XPER on MarketBeat in the last 30 days. This is a decrease of -67% compared to the previous 30 days. Xperi does not have a long track record of dividend growth. Upgrade to MarketBeat All Access to add more stocks to your watchlist.

- The consensus rating score for Xperi is 3.00 while the average consensus rating score for business services companies is 2.54.

- While the industry has been struggling with macro headwinds, its long-term prospects look impressive.

- Under terms of the merger, TiVo and Xperi shares will be converted into sha…

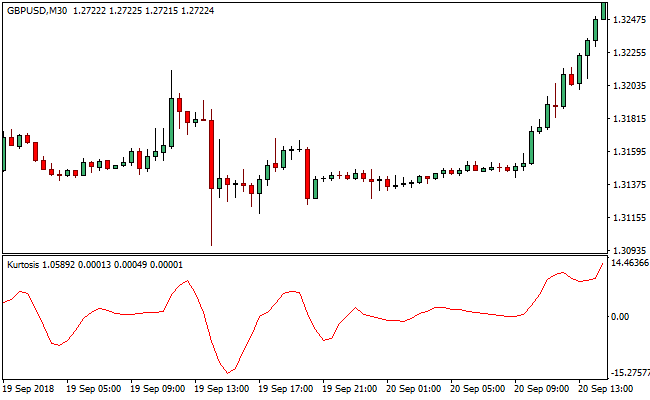

- The volatility ratio for the week is 2.71%, and the volatility levels for the past 30 days are 4.01% for XPER.

- 52 week low is the lowest price of a stock in the past 52 weeks, or one year.

For example, a price above its moving average is generally considered an upward trend or a buy. Intraday Data provided by FACTSET and subject to terms of use. Historical and current end-of-day data provided by FACTSET. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. The mean of analysts’ price targets for Xperi points to an 89.6% upside in the stock.

Watch out for dividend-stock ‘yield traps’ during the coronavirus crisis

The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. Directly connecting chips can increase data rates, decrease latencies reduce power consumption and heat generation and these bonds can be a lot stronger than those made with wires or other leads. These properties can be useful for SSDs as well as embedded consumer and industrial devices. BIA’s Rick Ducey tells us what to expect in the local ad marketplace for 2021 and how technology can keep ad dollars in traditional media.

Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. There may be delays, omissions, or inaccuracies in the Information.

Analyst Recommendation

Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. With an 82.7% surge in stock price since the beginning of the year, we look into Coinbase Global’s fundamentals to determine if the stock is worth the hype. Software giant Adobe continues to grow and retains a strong position in the software space, supported by strong demand for its offerings and continued innovation. Despite the Fed’s hawkish stance, the long-term prospects of the software industry look bright, thanks to rapid digitalization and growing dependency on cloud-based solutions. 52 week low is the lowest price of a stock in the past 52 weeks, or one year. 52 week high is the highest price of a stock in the past 52 weeks, or one year.

Xperi Inc. (NASDAQ:XPER) Shares Sold by Louisiana State … – Defense World

Xperi Inc. (NASDAQ:XPER) Shares Sold by Louisiana State ….

Posted: Mon, 10 Apr 2023 08:56:56 GMT [source]

One share of XPER stock can currently be purchased for approximately $10.12. Sign-up to receive the latest news and ratings for Xperi and its competitors with MarketBeat’s FREE daily newsletter. In the past three months, Xperi insiders have not sold or bought any company stock. MarketBeat has tracked 4 news articles for Xperi this week, compared to 3 articles on an average week.

TiVo and Amlogic Introduce TiVo OS Integration on Chipsets for Smart TVs

The receivables turnover for the company is 3.83 and the total asset turnover is 0.51. The liquidity ratio also appears to be rather interesting for investors as it stands at 2.21. Stephens gave a rating of “Equal-Weight” to XPER, setting the target price at $19 in the report published on August 02nd of the previous year.

Money Flow Uptick/Downtick RatioMoney flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an “uptick” in price and the value of trades made on a “downtick” in price. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. Our calculations are based on comprehensive, delayed quotes. Owning the operating system for connected TVs has become a hot battleground for market share internationally. In recent weeks, Samsung, LG, and Xperi have announced initiatives to expand their reach globally, as companies try to claim billions in ad dollars, data access and more opportunities.

Represents the company’s profit divided by the outstanding shares of its common stock. Our research shows that the odds of success increase when one invests in stocks with an Overall Rating of Strong Buy or Buy. View all the top-rated stocks in the Semiconductor & Wireless Chip industry here.

It accepts no liability for any damages or losses, however, caused in connection with the use of, or on the reliance of its advisory or related services. Xperi Inc. is currently not in a favorable trading position according to technical analysis indicators. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. Semiconductor demand is poised to grow due to its varied usage across emerging industries like the metaverse and AI. However, XPER’s higher growth and attractive valuations make it the better buy here.

Beyond what we’ve stated above, we have also https://1investing.in/ the stocks for Growth, Value, Momentum, and Sentiment. BWS Financial, on the other hand, stated in their research note that they expect to see XPER reach a price target of $30. The rating they have provided for XPER stocks is “Top Pick” according to the report published on October 06th, 2022. According a new report published by BloombergNEF on investment in the energy transition, annual spending on passenger EVs hit $388 billion in 2022, up 53% from the year before. Like we said, the boom is accelerating – and the time to buy EV-related tech stocks is now. Shares Sold ShortThe total number of shares of a security that have been sold short and not yet repurchased.Change from LastPercentage change in short interest from the previous report to the most recent report.

The industry with the best average Zacks Rank would be considered the top industry , which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. The Zacks Industry Rank assigns a rating to each of the 265 X Industries based on their average Zacks Rank. The scores are based on the trading styles of Value, Growth, and Momentum.

Moreover, XPER’s trailing-12-month Price to Book ratio of 0.58x compares with NVDA’s 24.39x. On the other hand, XPER’s revenue is expected to increase 6.3% year-over-year to $529.21 million in 2023. Its EPS is expected to increase 89.6% year-over-year for the same period.

- Financial technology company Robinhood’s shares are currently trading more than 40% below their 52-week high due to dampened investor sentiment amid mounting losses, a shrinking active user base,…

- Data may be intentionally delayed pursuant to supplier requirements.

- Xperi has only been the subject of 2 research reports in the past 90 days.

Industry Endorses Xperi with Leadership Award SAN ANTONIO , Dec. 19, 2022 /PRNewswire/ — Frost & Sullivan recently conducted research on the connected car in-cabin media industry and, after an exten… © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.

They are trying to find them, count their potential and bring them to their clients. Sign Up NowGet this delivered to your inbox, and more info about our products and services. Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style.

The chart below shows how a company’s ratings by analysts have changed over time. Each bar represents the previous year of ratings for that month. Within each bar, the sell ratings are shown in red, the hold ratings are shown in yellow, the buy ratings are shown in green, and the strong buy ratings are shown in dark green. To put it simply, Xperi Inc. has had a mixed performance in recent times.

Louisiana State Employees Retirement System Sells 60.2% of Xperi … – Best Stocks

Louisiana State Employees Retirement System Sells 60.2% of Xperi ….

Posted: Tue, 11 Apr 2023 10:05:28 GMT [source]

This represents a $0.20 dividend on an annualized basis and a dividend yield of 1.98%. The ex-dividend date of this dividend is Friday, August 26th. Xperi Corp. and TiVo Corp. announced Thursday an all-stock merger deal, creating a combined company with a enterprise value of about $3 billion. Under terms of the merger, TiVo and Xperi shares will be converted into sha…

On the other hand, NVDA has an overall rating of D, which translates to Sell. The POWR Ratings are calculated considering 118 different factors, with each factor weighted to an optimal degree. In terms of forward EV/Sales, XPER’s 0.70x is lower than NVDA’s 19.23x. Its trailing-12-month Price/Sales of 0.88x is 95.2% lower than NVDA’s 18.45x.

The company provided earnings per share guidance of for the period. The company issued revenue guidance of $510.00 million-$540.00 million, compared to the consensus revenue estimate of $529.21 million. According to analysts, Xperi’s stock has a predicted upside of 83.67% based on their 12-month price targets. Finzoomers got registered with IRDAI as Corporate Agent vide registration no. The average analyst rating for XPER stock from 10 stock analysts is “Buy”.