As over apps is actually strictly available for basic-time homeowners, there are many statewide applications to greatly help somebody trying to move from just one home they have had into the several other.

HFA Prominent

The newest PHFA even offers HFA Preferred so you’re able to both very first-time and repeat consumers. PHFA ‘s the servicer and you can deals with a network of approved lenders. For this reason design, consumers makes monthly premiums so you’re able to PHFA. Mortgage insurance is supplied by one of the private mortgage businesses in the event your deposit try lower than 20% of your price. Earnings limitations and you will credit constraints apply, so be sure to go to the web site to find out more.

Keystone Government Financing

Both for very first-time and repeat buyers, the brand https://speedycashloan.net/ new PHFA also provides Keystone Authorities Money. Such home loan items are supported by brand new Government Houses Government, this new Outlying Invention system of one’s USDA, while the Agencies away from Pros Things. Government funds keeps private restrictions and you may certain benefits by system, so make sure you have a look at site to find out more and see for individuals who can get meet the requirements.

Keystone Advantage Recommendations Mortgage Program

The latest Keystone Virtue Advice Loan System is obtainable so you’re able to each other very first-time and recite buyers to help with downpayment and you will closure prices guidelines. This is exactly in the form of another real estate loan where licensed borrowers could possibly get receive up to four per cent of your purchase rate or $6,000, almost any try reduced. The borrowed funds might be amortized over ten years during the zero % desire and should feel paid down monthly. Look for site to get more information and you will eligibility criteria.

Software having Persons with Disabilities

If a beneficial homebuyer is eligible getting an excellent PHFA mortgage and has now a handicap otherwise a household member has a disability additional financing is accessible to create usage of changes to their new home. From the PHFA Access House Modification Program, qualified receiver could possibly get discovered a no-attention mortgage anywhere between $step one,one hundred thousand and you will $ten,000, in combination with a great Keystone Financial or an effective Keystone Government Loan. Restrictions pertain, so be sure to check out the website to learn more.

In addition, through the Accessibility Downpayment and you may Closure Rates Assistance System, homebuyers may be qualified to receive doing $fifteen,000 when you look at the a zero-focus mortgage to put toward down-payment and closing pricing assistance. Eligible borrowers must use the Availability Family Modification System and you may meet money conditions. See site for details.

Boss Aided Homes (EAH) Step

Brand new PHFA lovers class with lots of performing businesses through the Personnel Aided Houses (EAH) Program provide a monetary family pick advantage to their employees to greatly help offer the cash a little next. When your employee qualifies getting a good PHFA home loan, they could discovered even more monetary benefits at the no additional expense to help you their boss. This might become an excellent Keystone Virtue Guidance Mortgage all the way to $8,one hundred thousand to put on the a down-payment or closing costs. For more information also to see in the event your boss is actually a good participating EAH lover, visit the webpages.

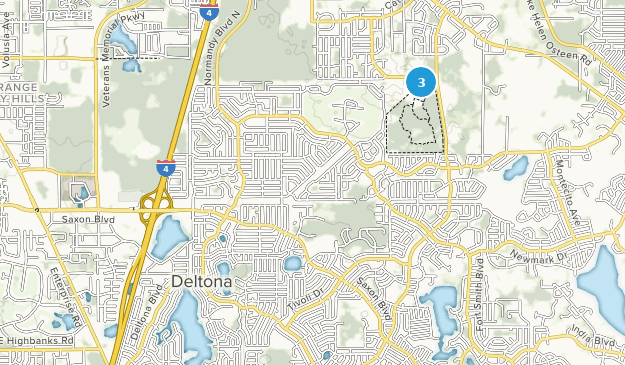

Homebuyer Applications of the Venue

And additionally statewide software, you’ll find tend to homebuyer guidelines apps located in other towns and you will aspects of a state.

Allegheny State

Homebuyers seeking are now living in Allegheny State, but outside the City of Pittsburgh, could be permitted apply for brand new Allegheny Condition Very first-Go out Homebuyer Program. This method, whenever offered, offers a minimal-appeal, 30-seasons repaired-price mortgage getting qualified individuals just who satisfy earnings constraints or any other criteria. Pick site to find out more and to incorporate.

Berks State

People of Berks State, including the Town of Training, might possibly make the most of financial help software through Society Casing Attributes away from Better Berks, Inc. So it company has the benefit of homebuyer education courses and you may ventures to possess homeownership capital and you will closing prices guidance. Pick site to possess facts and you can here is how to apply.