Texas Va Home loan

When you yourself have supported from the army now need to get a house from inside the Colorado, this new Virtual assistant mortgage program will probably be worth offered. This choice provides aided over 20 mil pros buy assets and you will also offers several benefits.

Brand new Virtual assistant money system was designed to let pros of Second Community Battle buy a home. It allows qualifying homebuyers to obtain the property they require with greatest terminology.

Zero Off

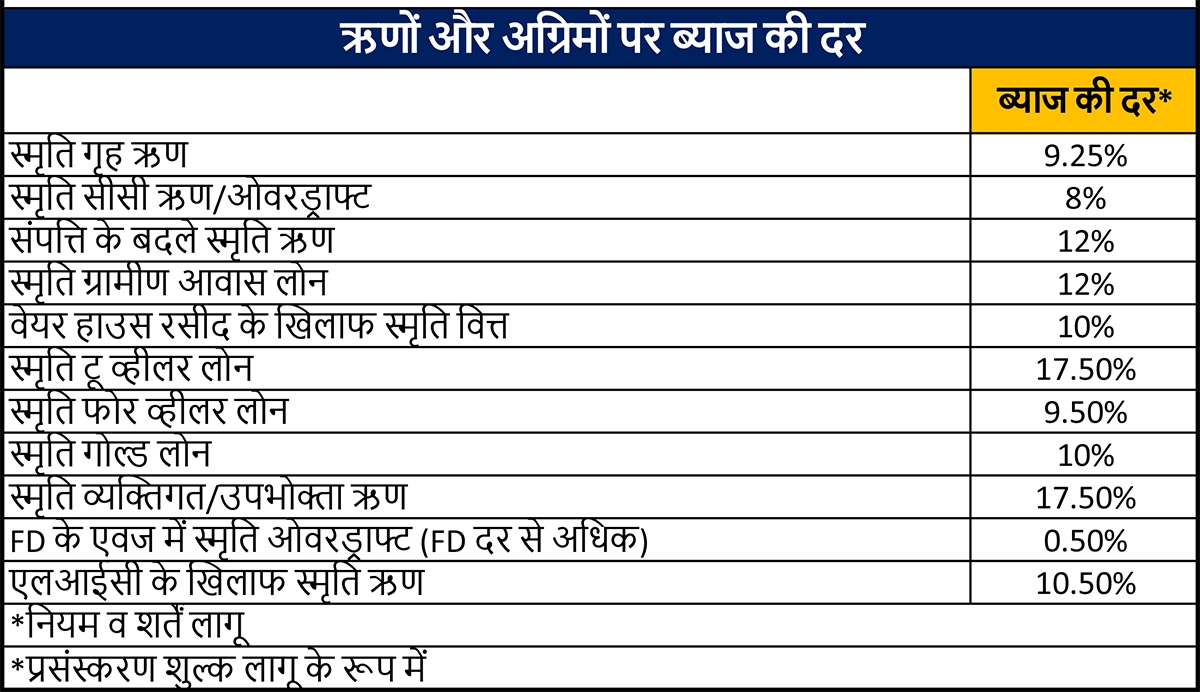

Choosing the currency to possess a downpayment will be tough, especially for very first-day buyers, however with the brand new Virtual assistant that isn’t a problem. Even if you you prefer 3% that have a traditional financing otherwise 3.5% having a keen FHA financing this new Va does not have any so it requirements.

If you meet the qualifying conditions you can purchase a house rather than a down-payment through the Virtual assistant loan program.

Competitive Interest levels

Virtual assistant money commonly provide competitive rates, like traditional and you may FHA finance. These types of money are given as a consequence of registered lenders, and you’ll realize that you get even better cost for the some situations.

Less than perfect credit

Even though you don’t have an effective credit history you could potentially nonetheless be eligible for a good Virtual assistant mortgage. If you have an excellent latest track record having expenses debts punctually, you could however qualify with all the way down a credit rating. You will need to reveal that you can keep above of your debts for the past 1 to 2 ages.

All the way down Settlement costs

After you sign the newest documents order your home you can find of numerous fees to invest. This can include appraisal fees, identity insurance rates, homeowners insurance, and property fees, among almost every other expenditures. But not, the newest Virtual assistant constraints some of these charge.

Second-Level Entitlement

The brand new Virtual assistant might allows you to buy a moment house for those who have an obvious reason along with sufficient entitlement remaining shortly after your first mortgage. This feature is named Virtual assistant Second-Level Entitlement.

The fresh Virtual assistant guarantees twenty five% of your amount borrowed, and you need to fully grasp this quantity of entitlement leftover to help you have the home you want instead of a down payment.

The fresh new priount was significantly less than $144,000. Which https://simplycashadvance.net/loans/holiday-loans/ have higher loan number the latest Va mortgage limitations determine your secondary entitlement. In Colorado throughout counties, the current Va loan restriction is actually $766,550. This is why your current full entitlement are $191,637.

For folks who have you to definitely Virtual assistant home loan, your kept entitlement you can expect to allows you to buy one minute family and no down payment depending on how far entitlement are leftover.

If you have prior to now started foreclosed into good Va mortgage, the fresh entitlement you put should be subtracted for those who need it an alternate property. The lending company might also require that you done a standing up period before applying to own a special home loan.

Without having sufficient entitlement you could potentially nonetheless purchase a home if you have the money having an all the way down commission. New downpayment you certainly will be below you would keeps to spend that have a conventional mortgage, as you just need to spend the money for difference in the remaining entitlement and you may twenty five% of the purchase price.

Qualifying to have an effective Va Financing in Tx

It should be more straightforward to be eligible for a beneficial Virtual assistant mortgage that have typically shorter strict credit criteria than the other choices, but you’ll should also fulfill eligibility criteria. Our home we need to buy also offers to get to know particular requirements toward loan is acknowledged.

Financing Qualification within the Colorado

As benefits of using an excellent Virtual assistant mortgage order your home is actually glamorous, it is simply available to some people. You need to be entitled to a Va loan while you are currently throughout the armed forces or was indeed in the past.