Whether you’re building yet another household on the ground right up or looking to undertake significant structural renovations, a home loan having a housing choice could be an effective choice for you. Here’s everything you need to understand exactly how which helpful family mortgage feature really works.

Looking for a property that fits your entire needs is not an simple task. If you’re strengthening your perfect home is a large project, it offers independence and you can freedom to create something good for your, out-of color in order to pavers and you will everything in between.

Mortgage brokers with a property option is actually some time dissimilar to practical lenders they truly are organized as much as progressive costs during your create to simply help do the fresh new project’s earnings, in lieu of borrowing from the bank a lump sum.

Publication an appointment

A devoted lender will get into touch along with you in this step one business day. They’ll reply to your questions about mortgage brokers and assist you by way of next tips. Your financial can initiate the program to you.

How come modern drawdown performs?

The most important thing one to set a home loan which have a houses solution apart from a standard mortgage ‘s the progressive drawdown construction of financing.

In advance of framework begins, the builder, usually which have assistance from a loan provider, tend to prepare yourself a document outlining the complete cost of the latest build and you will broke up the overall prices it into level that upgrade the newest commission plan.

- Slab installing the origin, levelling a floor, plumbing work, and waterproofing the origin.

- Physical stature strengthening new frames, partial brickwork, roofing, trusses, and you may window.

- Lockup outside walls, lockable windows, and you will gates.

- Fit out gutters, plumbing system, energy, plasterboards, plus the limited installation of cupboards.

- Completion finishing touches, latest plumbing, power, total cleanup, and you can last payments to own products and you may designers.

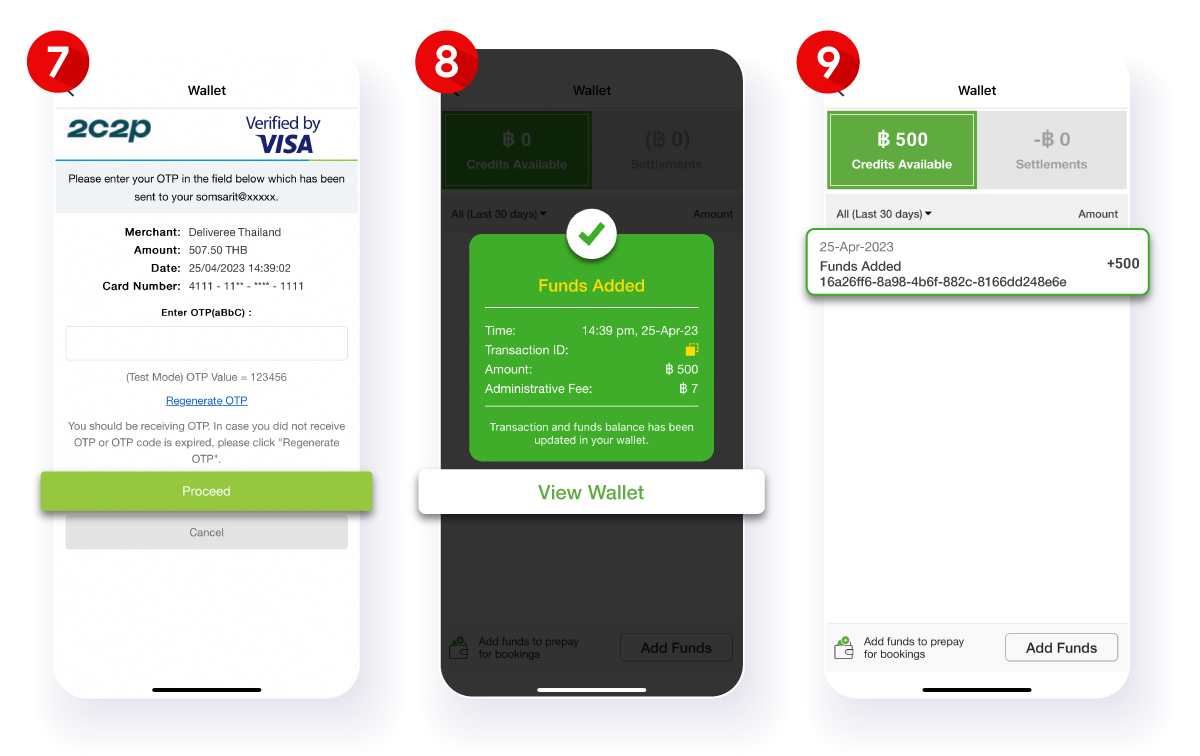

Immediately following for every single phase is completed, new creator have a tendency to thing an invoice. Ahead of releasing money (or improvements payments) straight to the new builder, your bank could possibly get posting someone to your property to ensure you to for every phase of make are moving on correctly.

A final improvements payment could be susceptible to a suitable last inspection from the lender’s valuer, guaranteeing the building might have been completed according to the modern agreements and specifications.

What is the difference between a home loan that have a property choice and you may a simple home loan?

As well as the progressive drawdown construction, there clearly was you to secret difference in basic home loans and the ones that have framework alternatives for that look out for.

If you are a basic mortgage fees your focus to your complete loan amount from payment, a houses option divides your loan for the amounts of your strengthening processes. Generally speaking, a construction choice even offers interest-just repayments during framework to support cashflow. These will likely then revert so you’re able to a fundamental dominating and you may notice loan once your house could have been totally depending.

This means that you can only generate attention money to your loans you to was pulled off at that time in the act perhaps not the complete loan amount up front which means straight down money for your requirements. not, its worth observing that the interest costs accumulated throughout the the build months often slowly raise since your bank will continue to release the money to expend their builder’s statements.

How will you score a home loan which have a property choice?

Strengthening your own property is an excellent chance to get what you you desire in a property and you will a property option could be the way to make it happen.

The application form process because of it style of loan is different from that out of a fundamental financial. Borrowers will have to provide the bank with a good amount of relevant documents, along with council-approved agreements and requirements, your own finalized and you can old strengthening price, developers chance insurance info, quotes from designers, and additionally all you need to apply for a normal financial, such as for instance specifics of your earnings, work, and you can credit score.

Your own bank will additionally you desire a lender valuation of recommended this new design. That it valuation may be payday loan online Holly Pond AL used of the a subscribed valuer nominated because of the, and on account out-of, your lender.

Once your mortgage is eligible, you may then have to pay the new put, a statistic which could differ all over loan providers. From the Westpac, i fundamentally wanted a 20% put (and you may financing-to-really worth proportion (LVR) below 80%) to possess lenders which have framework alternatives the same as other practical home loans. You could nonetheless make an application for a homes home loan solution that have an LVR above 80%, but you’ll probably have to pay loan providers home loan insurance policies (LMI). You will discover about preserving getting in initial deposit and you will LMI right here.

not, no matter what much thought you do, unexpected framework can cost you and you may delays are now and again inevitable. This helps look for laws, financing standards together with strengthening processes. Take a look at the Australian Government’s yourhome site for more information.

Before generally making the choice to pull out a mortgage with a construction alternative, it’s best to speak to an expert which get help you decide what exactly is effectively for you as well as your financial situation. Has actually issues? Call us into the 132 558, discover more about design home loan choice, Westpac’s most other mortgage situations, or head to one department across the Australia to talk to your neighborhood Home Money Movie director.