Content

They’re less useful for money you might need to access quickly, such as an emergency fund. Bankrate follows a stricteditorial policy, so you can trust that our content is honest and accurate.

- Read a certificate of deposit definition, learn the advantages and disadvantages of certificates of deposit, and see examples.

- And the odds are low that the bank where your CD is maturing is currently a top-rate provider among the hundreds of banks and credit unions from which you can choose a CD.

- CDs from online and smaller institutions have higher interest rates.

- For instance, some of the best CD rates you’ll see have unlikely terms such as five months, 17 months, or 21 months.

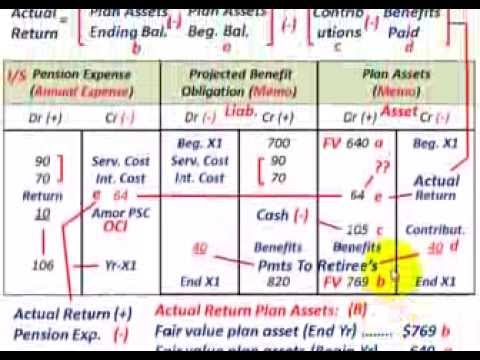

- This Professor Savings video warns people considering purchasing CDs.

- In combination with recent market volatility, advertisements for CDs with attractive yields have generated considerable interest in CDs.

In general, and in common with other fixed interest investments, the economic value of a CD rises when market interest rates fall, and vice versa. And compounding is when your account earns money off both the original deposit and the increasing interest. A CD is different from a traditional savings account in several ways. Receive monthly direct deposits totaling $1,500 or more to earn 0.40% APY. Use your Axos Visa® Debit Card for a total of 10 transactions per month (min $3 per transaction) or sign up for Account Aggregation/Personal Finance Manager in Online Banking to earn 0.30% APY. Maintain an average daily balance of $2,500 per month in an Axos Managed Portfolios Invest Account to earn 0.20% APY. Maintain an average daily balance of $2,500 per month in an Axos Self Directed Trading Invest Account to earn 0.20% APY.

Get a Certificate of Deposit at First Alliance Credit Union

Even to the extent that CD rates are correlated with inflation, this can only be the expected inflation at the time the CD is bought. Locking in the interest rate for a long term may be bad or good . For example, in the 1970s, inflation increased higher than it had been, and this was not fully reflected in interest rates. This is particularly important for longer-term notes, where the interest rate is locked in for some time. ] A little later, the opposite happened, and inflation declined. Smaller institutions tend to offer higher interest rates than larger ones. Savings accounts give regular access to your money; CDs don’t.

- When taxes are considered, the higher-rate situation above is worse, with a lower real return, although the before-tax real rates of return are identical.

- Discover Bank does not provide the products and services on the website.

- It is generally accepted that these penalties cannot be revised by the depository prior to maturity.

- See today’s mortgage rates, figure out what you can afford with our mortgage calculatorbefore applying for a mortgage.

- You should continue researching until you are comfortable that the deposit broker is reputable.

That means it can be harder to use CDs to accumulate the funds you will need for retirement. When looking for a low-risk investment for their hard-earned cash, many Americans turn to certificates of deposit . In combination with recent market volatility, advertisements for CDs with attractive yields have generated considerable interest in CDs. CD rates are largely dependent upon the current interest rate environment. If prevailing interest rates are high, financial institutions will pass those rates on to CD investors. BanksYou can shop for certificates at both traditional brick-and-mortar banks or online banks.

things to know before accepting a first job offer

#5 – Liquid or “No penalty” CD –The liquid CD allows the depositor to withdraw the money during the tenure without payment of any early withdrawal penalty. It is flexible enough to shift the funds from one CD to a higher paying CD.

What Is a Certificate of Deposit (CD)? – msnNOW

What Is a Certificate of Deposit (CD)?.

Posted: Mon, 13 Feb 2023 16:25:40 GMT [source]

The rate of interest on your CD may be less than the rate of inflation. In times of high inflation, coupled with federal and state income taxes on interest and any early withdrawal fees you may incur, it is possible to lose money over time in a CD. CDs can reflect fixed-rate or variable-rate interest terms, with fixed arrangements being the most common.

Financial Overview

Certificate of Deposit – Definition & Features are generally thought of as one of the safest types of investments. Firstly, the fixed interest rate locks in the amount of yield that is going to be earned, reducing the volatility of returns for the investor. In addition, the deposit is guaranteed by the bank that issues it. Best high-yield savings accounts if you want the flexibility of adding funds over time or taking advantage of higher rates. A real-world example of a certificate of deposit could be those offered by commercial banks such as the Bank of America, Fidelity or Discover Bank, etc.

- With these advantages and disadvantages in mind, it is wise to consider that CD advantages usually outweigh the disadvantages.

- This can be advantageous, as smaller banks may not offer the longer terms of some larger banks.

- The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

- Asking the right questions can help you determine if a CD is a good fit for your financial situation.

- At that point, you have no option but to continue with the term as-is or pull the money out and incur penalties.

- A certificate of deposit, or CD, is a savings vehicle with a fixed deposit held for a fixed term and yielding a fixed rate of interest.

Liquid CDs pay less interest compared to the fixed period standard CD. Most typically, the EWP is charged as a number of months’ interest, with a greater number of months for longer CD terms and fewer months for shorter CDs. These are just examples, of course—every bank and credit union sets its own EWP, so it’s important to compare EWP policies whenever you are deciding between two similar CDs. Then, when the first CD matures in a year, you take the resulting funds and open a top-rate five-year CD. A year later, your initial two-year CD will mature, and you’ll invest those funds into another five-year CD. When Fed money is cheap (i.e., the federal funds rate is low), banks have less incentive to court deposits from consumers.

You must cCreate an account to continue watching

Any withdrawal of deposit before maturity in most cases will occur at the cost of a withdrawal penalty. #1 – Traditional CD –It is an age-old type of CD that comes with a fixed rate of interest, strict penalty on early withdrawals and federal insurance. Some savers like CDs because of the safety they provide, as well as the fact that they are perfectly predictable.

Can you lose money on CDs?

There’s no risk of losing money with a CD, unless you withdraw funds before the maturity date. If that happens, you may lose some or all of the interest you’ve earned to the early withdrawal penalty.

If you like the sound of CDs but want to keep your money accessible, you might consider building a CD ladder. You are leaving Discover.com and entering a website operated by a third party. We are providing the link to this website for your convenience, or because we have a relationship with the third party. Discover Bank does not provide the products and services on the website. Please review the applicable privacy and security policies and terms and conditions for the website you are visiting. Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances. For personal advice regarding your financial situation, please consult with a financial advisor.

Webinar: Bank Notes: College cost comparison

Another difference is that FDs come with high https://personal-accounting.org/ of interest as compared to CDs. Lastly, CDs are negotiable and can be traded in the secondary market; most FDs don’t have this feature. Even though opening a CD involves agreeing to keep the funds on deposit without withdrawals for the duration of the term, that doesn’t mean you lack options if your plans need to change. Second, CD investments are protected by the same federal insurance that covers all deposit products.