When you are a resident around australia wanting an effective way to Montana loans availability cash, a property collateral loan is the services you desire. A home security loan makes you borrow on the new equity on your own property, providing you with the economic self-reliance you should achieve your needs.

With a home collateral mortgage, you might often obtain as much as 80% of one’s property value your house, with versatile installment terminology between step 1 to help you three decades. Our very own home loans can assist secure a security mortgage with focus rates that will be extremely competitive, it is therefore a reasonable choice for people who want to discover the worth of their residence.

Whether you’re trying to renovate your property, combine loans, or create a huge pick, a house collateral loan makes it possible to achieve your needs. And because it’s a protected financing, you ounts within less interest rate than an unsecured individual loan.

Our software procedure is fast and easy, and we away from knowledgeable mortgage brokers are right here to aid your owing to each step of the means. So, when you’re a resident in search of an adaptable, sensible means to fix availability bucks, apply for a house security financing with our company now and take the first step to the achieving your financial specifications.

How can i create equity in my home?

There are numerous an approach to raise your home’s guarantee which you’ll boost the worth of a guarantee mortgage. Check out an effective way to do it:

- Raise your Payments If you improve regularity out of repayments on your own financial monthly, this can increase the amount of security therefore the rate during the which you collect guarantee. As you always reduce your loan, your increase your equity.

- Pay A great deal more As opposed to enhancing the frequency of money, you might pay only significantly more any time you make a fees. This can along with reduce your loan prominent reduced that will raise the latest security of your home.

- Upgrade the house or property Remodeling the house increase their worthy of which in turn, increases the number of equity you have at your home. You can get pre-accepted having a renovation home loan first off capital renovations to help you enhance your guarantee.

What’s home guarantee & how can you utilize it?

Security ‘s the worth of that you individual and that’s measured by deciding the bill in your home financing as opposed to the importance of the home.

Such as for example, if the house is really worth $500,000 therefore are obligated to pay $250,000 in your mortgage, then security of your home try $250,000.

In the event the worth has increased throughout your lifetime of running they, this means you have far more security in your home than you thought. In the event your value possess reduced, then you will get faster equity and it might not be the correct time to get property collateral loan.

In certain circumstances, residents could actually be under water or ugly on the home loan. This means that the total amount due on house is more the value of the house or property.

When you have self-confident collateral yourself you may be entitled to located up to 80% of your current worth in the form of a security house loan.

Household Loans Possibilities

- Financial Pre-Acceptance

- Adjustable Price Home loan

- Fixed Price Financial

- Split up Loan

- Interest Merely Lenders

- Family Guarantee Mortgage

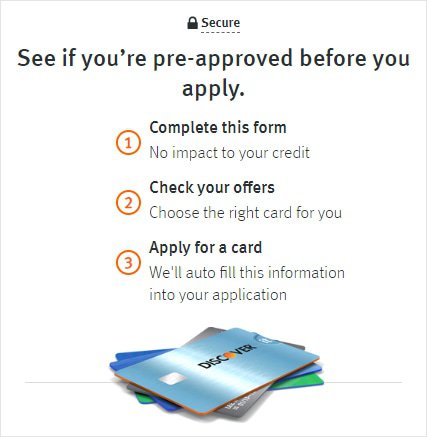

Applying for home loan pre-recognition can provide best away from how much your could afford to acquire, so that you know your limitations when shopping for your dream household.