By Daniel Avancini | that have 0 Comments

![]()

Smart finance companies will begin their AI conversion process work by the examining its capabilities right after which deciding and this AI innovations he’s in a position to out of supporting.

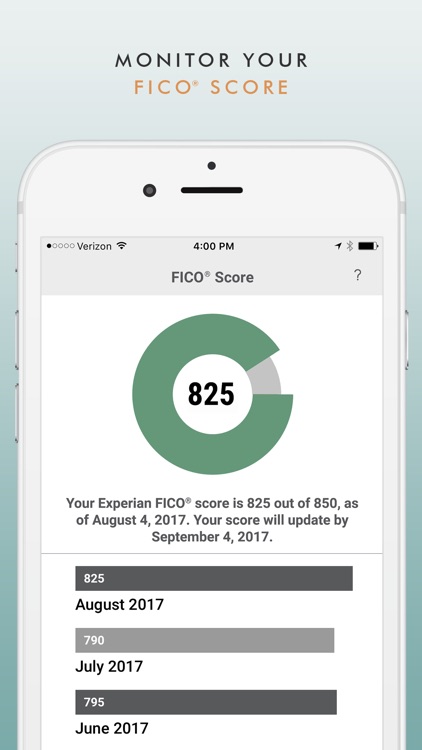

When it comes to partnering AI to your team, the brand new loans industry is currently far before much of its co-workers. Banking companies have used formulas and you may ancient machine reading having line techniques including swindle recognition and you may credit reporting.

However, that does not mean that fund world lacks space so you can expand from the field of AI. To the contrary, by taking advantageous asset of newer version of AI technical, such as generative AI, banks can also be twice upon the benefits you to definitely AI currently will bring to this sector that is on track to boost full revenues because of the perhaps almost 5 percent compliment of went on AI invention, predicated on McKinsey.

Let me reveal a glance at the way the next age bracket regarding AI sales from inside the financial sometimes enjoy out and you will just what financial institutions will have to do to make certain they truly are prepared to just take full benefit of modern AI.

Just how AI usually remold fund: Five long term installment loans for bad credit examples

Modern AI technology is primed in order to effect financial institutions across the several regions of process, as the creativity are likely to occur in certain contexts in advance of anyone else.

1) Incorporating results to back-workplace surgery

The back work environment meaning the fresh management section of a finance company rather than the client-up against part is among the first areas where next-generation AI technology disrupts banking surgery. Right here, generative AI can speed up repeated and go out-consuming employment including generating compliance profile and you will consolidating records expertise adopting the acquisitions.

I probably will not look for loads of headlines in the genAI-dependent innovations for the areas such as because they are maybe not of them you to banks’ consumers often observe. But from an operational direction, partnering AI much deeper to your back place of work techniques might have an excellent powerful effect on total output and you can Bang for your buck. It will allow it to be banking companies to try out even more tricky opportunities, including staying prior to regulating laws that will be constantly broadening alot more advanced, versus increasing its straight back-place of work headcount or group costs.

2) Enhancing traditional fund AI options

A unique very early chance for taking advantage of modern AI technology in the finance is using they to maximize brand new AI solutions you to definitely banks already enjoys positioned like, once again, those who do fraud detection and credit rating.

I’m not talking here about reconstructing such expertise from scratch. Instead, expect to discover banks make changes such as for instance incorporating the new sorts of investigation to your old-fashioned AI systems. Including, as opposed to trying discover scam by looking simply for defects into the commission transactions, a financial might also learn real-big date online streaming videos about section out-of sales to assess if or not the person trying buy something is the genuine account holder.

Updates such as these you may somewhat boost the accuracy out of old-fashioned AI assistance regarding funds market, which would, in turn, increase Roi minimizing will set you back.

3) Providing it really is personalized experience

The concept of alteration or customization is certainly essential in funds. Generally, yet not, most personalization perform from the banking institutions had been restricted. A bank you are going to promote a charge card designed for people in its 20s or individuals who such as for example rock tunes, for instance. But getting it really is individual banking services and products which might be designed per personal client hasn’t been possible.

Modern AI technical transform so it, but not, through it you can easily each other to do hyper-individualized research of each user’s choices and to create personalized articles to possess products. Believe, as an instance, a banking site whoever posts try automobile-made on travel of the an enormous vocabulary model (LLM) showing opportunities interesting to each personal associate.

These creativity will take some time to create. Currently, units to be used times such as for example for the-the-travel age group of website content from the AI patterns are not adult. But it is feasible sufficient to carry out, and it is more than likely simply a matter of day prior to designers do the tools to do it.

4) Wealthier data supply and analytics to possess algorithmic trade

For many years, advanced level dealers purchased research provide eg satellite images to achieve beneficial wisdom on the where you should lay their money. However they have relied largely to the guidelines methods to translate and you may respond to one to research.

With modern AI, these procedures could be fully automated, enabling hedge loans and you may capital banking institutions to take algorithmic trade so you’re able to an alternative height. Like, they could deploy AI assistance one display screen this new procedures off manufacturing herbs after which immediately make investments considering whatever they discover.

Here again, steps in this way need extremely sophisticated options you to (in terms of the general public knows, at the very least) features but really getting oriented. Although AI technology needed to build all of them is here.

Making preparations ways to own AI innovation during the investigation

Even in the event banking institutions is commercially begin strengthening the kinds of AI choices discussed over now, they aren’t likely to score very far except if it target a great few secret AI demands earliest.

One is the necessity for a wholesome research foundation. Without higher volumes regarding top quality analysis, carrying out AI options capable of handling cutting-edge funds fool around with instances usually show hopeless. This is also true into the financial business, in which study can become highly siloed ranging from other sorts of possibilities including the es you to definitely nonetheless energy specific financial properties and newer Customers Relationships Administration (CRM) or transformation networks one banking institutions have also accompanied.

Banking institutions will additionally have to evaluate and you can target the safety pressures close modern AI tech. When you find yourself AI will help speed up safeguards techniques during the finance, faults into the AI expertise can make the fresh new dangers. For instance, suppose chances actors are able to poison this new LLM one a lender hinges on to help with consumers whoever account are secured due to guessed con. The newest crooks may potentially key the newest LLM into the inducing the levels become reopened, effectively beating the fresh new scam safeguards regulation.

A new book complications you to pops up when groups embrace generative AI try a prospective insufficient transparency about how exactly choices manufactured. This may show particularly tricky for banking institutions, and this either face regulatory standards to provide an explanation to have tips including closure membership or doubting loan applications. When the these behavior are produced by the black box AI services, finance companies may not have the info they have to identify the decision-and then make.

Conclusion: The ongoing future of AI within the banking

AI might not be new during the loans, however, new sort of AI has established a beneficial trove away from novel potential to have enhancing financial functions and processes. However, permitting such designs demands more access to modern AI tech. Banking companies likewise require the data, protection, and you may visibility choices needed seriously to address the initial demands posed by the next-age bracket AI. Wise financial institutions will start the AI conversion process efforts because of the determining its possibilities on these parts immediately after which deciding which AI innovations he or she is ready support.