Not totally all bills have been made equivalent. When it comes to to buy a home, certain costs are a good idea and several, really, we are able to really do in place of. Let’s investigate different varieties of personal debt and how they you are going to apply at your property loan borrowing from the bank strength.

Signature loans and covered car and truck loans

Personal loan financial obligation reduces the level of earnings you have got to solution home financing, in turn probably cutting your borrowing capabilities. Personal loans also normally have highest rates. When the a varying rate of interest is actually connected with the loan, lenders can also increase a boundary to support upcoming interest rate rises.

Shielded car and truck loans always offer lower rates than just unsecured personal money as the loan signifies a lowered chance to the lender. Thus if you’re a secured car finance usually still affect the credit capability, it might not provides while the big a direct effect just like the an enthusiastic unsecured personal bank loan.

On the bright side associated with the, a totally paid car loan can help the application. Showing you were capable always help make your auto loan repayments on time could make your house application for the loan stronger.

Pupil loans

Your earnings instead of your own costs versions a big part of financial application review. Rather than really expenses, college student loans has an effect on the income region of the equation. Since the at the , because the minimal fees money tolerance are met, the installment cost start at the 1% of one’s income while increasing since you earn more, as much as all in all, 10% of the income. How much cash you earn identifies how much you have to pay back, and as a result, the result that it debt is wearing your borrowing from the bank capabilities. Some loan providers may determine beginner debt in a different way, but it doesn’t matter how it prefer to treat it, student obligations has a tendency to involve some influence on the borrowing from the bank power.

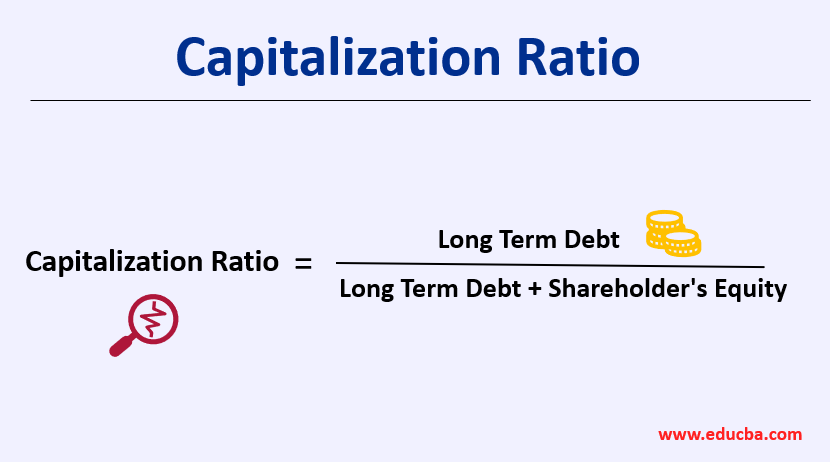

Established mortgage

For individuals who currently own a home well-done! This can be particularly a stunning completion. Even if buying your basic house could have left your with a big amount of personal debt, it’s not all not so great news! If you have lived-in your residence for a while you could be able to make use of your own equity to manufacture a more impressive deposit for the next assets. People income from financing services you will improve your borrowing potential and you may let the loan app.

Credit debt

Credit debt could be extremely confusing, and there is enough conflicting pointers around their affect providing a home loan.

Its prominent to listen you to credit cards will help alter your credit history. Whilst not a complete myth, a more direct report is credit cards will help improve your credit rating if you are in control. Using handmade cards responsibly will help demonstrate to loan providers you might be an excellent reputable, low-exposure borrower. The way you shell out almost every other repeating expenditures, particularly mobile costs and even gym subscriptions, may also contribute to your credit rating. For additional information on fico scores in order to find out how you may a totally free content of yours, see ASIC’s Currency Wise website.

Loan providers don’t just check your mastercard balance and you will repayments. What is actually also important on it ‘s the borrowing limit of any cards. When you yourself have multiple playing cards and thought this might connect with your own borrowing from the bank strength, it would be smart to communicate with a lender and you may mention closing some cards levels or lowering the restrictions to help you see if this helps your home application for the loan.

Mutual loans

If you have removed financing which have anybody else this will make you a co-debtor, and to very loan providers your co-debtor was one another together and you will directly liable for the debt. As a result whether your other person is actually unable to pay off the borrowed funds, you may be americash loans Welby after that completely accountable for new outstanding equilibrium (and vice versa). This does not amount in the event your person you display the borrowed funds that have will additionally be for the mortgage. However if they’re not, one loans represents most of the yours and this you are going to somewhat apply to the borrowing from the bank ability. When you find yourself in this situation and would like to improve your borrowing strength, certain loan providers might possibly be happy to just take into account your express of one’s personal debt if you’re able to offer evidence others co-debtor will pay theirs.